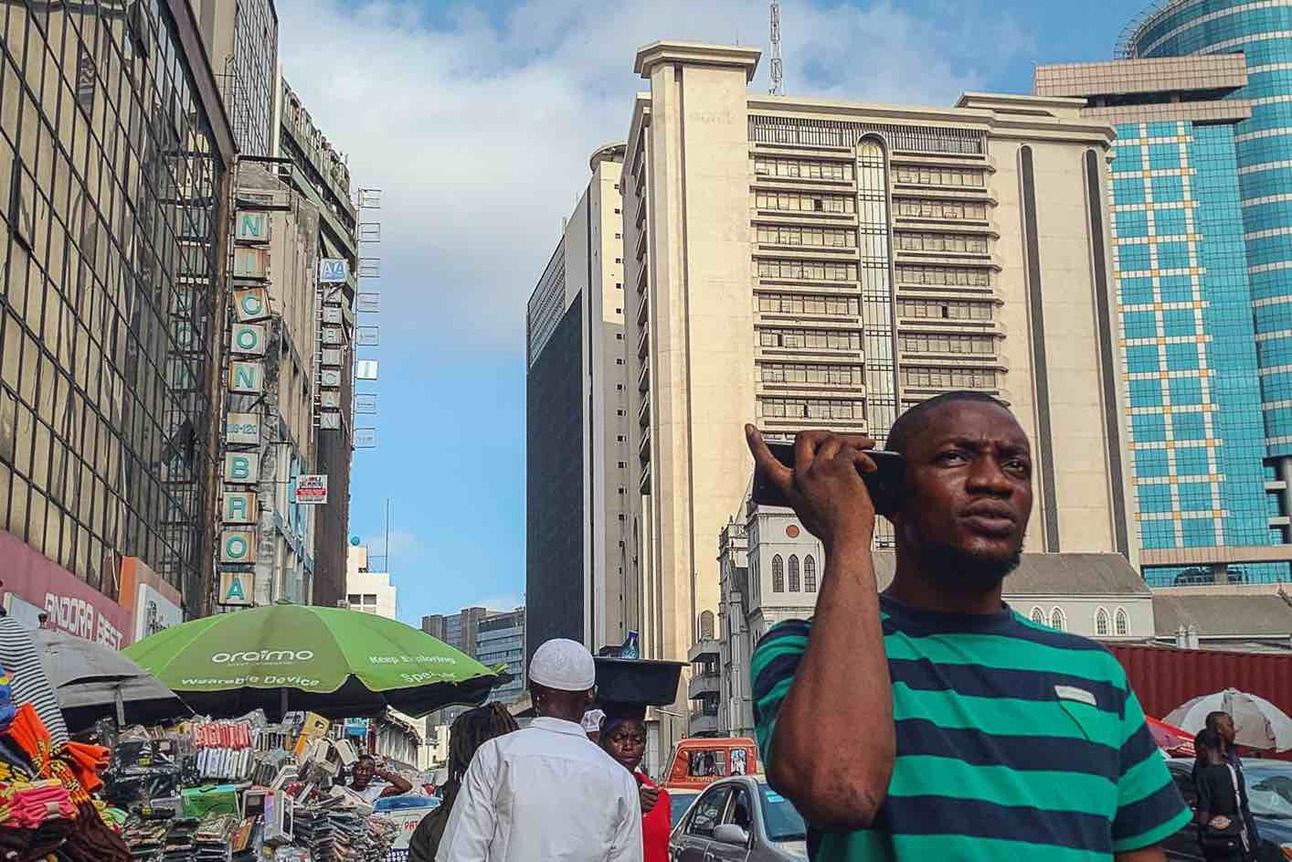

A bustling street scene in Lagos, Nigeria’s commercial hub. Moody’s Investors Service raised its rating outlook on Nigeria to positive from stable, citing progress in reforms. Photographer: Samuel Okocha/234Digest

Nigeria's economy and business environment may be on the verge of a turnaround, after Moody's Investors Service raised its outlook on the country's credit rating to positive from stable.

The rating agency said the positive outlook reflects the authorities' reform efforts, which could reverse the deterioration in the country's fiscal and external position.

What is a fiscal and external position and why does it matter?

The fiscal position refers to the balance between the government's revenues and expenditures, and the level and sustainability of its public debt.

The external position refers to the balance between the country's foreign exchange earnings and payments, and the level and sustainability of its external debt.

A strong fiscal and external position means that the country has enough revenues and foreign exchange to cover its spending and debt obligations, and that its debt is manageable and affordable.

A weak fiscal and external position means that the country has a large budget and current account deficit, and that its debt is high and burdensome.

How Nigeria's reforms could improve its fiscal and external position

Nigeria, Africa's largest economy and biggest oil producer, has suffered from the coronavirus pandemic and the slump in crude prices, which account for the bulk of its foreign-exchange earnings.

The government has embarked on a series of reforms, including removing fuel subsidies, liberalizing the electricity sector, and unifying the exchange rate, to boost revenue and attract investment.

“These policy changes, and those potentially to come, have raised the prospects of a fiscal and external improvement in the country’s credit profile,” Moody’s said in a statement as reported by Reuters.

The authorities efforts to increase non-oil revenue, improve the quality and efficiency of public spending, and foster economic diversification have the potential to durably improve Nigeria's fiscal and external metrics over the medium term.

What the raised outlook means for Nigeria and its investors

The raised outlook is a positive signal for Nigeria and its investors, as it means that the country may face less difficulties in accessing external financing, especially from the international debt markets, where it may have to pay lower interest rates to attract investors.

“It’s a good signal to international investors or businesses looking to come into the country or to deal with Nigerian entities,” Managing Director at Arthur Stevens Asset Management, Tunde Amolegbe, told Nigeria’s Punch Newspaper.

It also means that Nigerian businesses and investors may face lower borrowing costs, higher profitability, and increased confidence in the domestic economy.

What challenges and opportunities lie ahead for Nigeria

Nigeria's credit rating remains constrained. Moody’s Investors Service affirmed the country’s rating at Caa1, seven levels into junk due to “still weak” fiscal and external positions, noting the reforms may not be enough to improve its credit profile, wrote Bloomberg.

The rating agency may consider upgrading Nigeria's rating in the future if the reforms are sustained and the economic and institutional resilience is enhanced.

This news story is brought to you by 234Digest, your premier source for unbiased news, insights, and features on Nigeria's economy and business environment. Stay informed and ahead of the curve by subscribing to the newsletter, delivered twice weekly to your inbox.